Top-Rated Independent

Insurance Agency

At Braly Insurance Group, we combine local expertise with a diverse range of coverage options to meet your unique insurance needs. Your protection is our top priority.

To us, successfully protecting you is a BIG deal

About Us

Your Trusted Insurance Agency Since 1997

At Braly Insurance Group, we understand the complexities and challenges that individuals and businesses in Texas face when seeking reliable insurance coverage.

As an independent agency, our core philosophy is centered on educating both individuals and businesses about the most beneficial insurance options designed specifically for their distinct needs.

Our method is intensely personalized, involving thorough assessments to accurately identify and address potential risks. This meticulous process guarantees that our clients receive tailored insurance solutions that perfectly match their requirements.

At Braly Insurance Group, we merge our comprehensive understanding of diverse insurance products with a true enthusiasm for client satisfaction. This combination of knowledge and commitment allows us to offer not just insurance policies but a sense of security and trust, ensuring that our clients are thoroughly protected and well-informed at every turn.

Experience the peace of mind that comes with knowing you’re covered by Braly Insurance Group.

Reasons to work with braly

Why work with Braly Insurance Group

With a legacy of excellence and commitment, Braly Insurance Group is dedicated to understanding your unique needs and crafting affordable, comprehensive insurance solutions to protect your assets.

Local Expertise with a Personal Touch

Deeply rooted in our community, we blend local knowledge with a variety of coverage options, ensuring your insurance is as unique as you are.

- In-depth understanding of local regulations and needs

- Personalized service from agents who are part of your community

- Tailored solutions that reflect local conditions and requirements

Tailored Coverage Plans

We believe every client is unique. Our specialty lies in creating customized coverage plans that reflect your specific needs, moving away from one-size-fits-all insurance.

- Customized policies designed to meet your specific needs

- Flexible options that adapt as your circumstances change

- Dedicated advisors who take the time to understand your unique situation

Strategic Carrier Partnerships

Our strategic partnerships with top-rated insurance carriers guarantee you the best coverage at competitive rates. We focus on quality and value, providing peace of mind knowing you're well-protected.

- Access to a broad range of top-rated insurance carriers

- Competitive rates without sacrificing coverage quality

- Reliable and robust coverage options backed by industry leaders

Testimonials

Real Insurance Clients with Honest Reviews

Braly agency was very honest and professional to work with. They have many resources to choose from and are a full service Insurance Agency. I highly recommend! Caden provided excellent and knowledgeable service throughout the process.

Louis G.

Insurance Client

I have been with the Braly Group for years. Their attentiveness gratitude and all around a good group to take care of your insurance and others needs.

Thanks for being amazing,

Jeff D.

Insurance Client

I have been with the Braly Insurance Group for over 10 years! Absolute professionals who definitely take care of you personally. I trust the Braly Group to give me the best product and price for my insurance needs!

Doug F.

Insurance Client

Everyone at Braly Insurance is always friendly & helpful. Whether you need to file a claim or make changes to your policy they are there to help with whatever you need.

Terry B.

Insurance Client

Meet our team

The Braly Insurance Group Team

Here at Braly Insurance Group, our goal is to provide you with fair policies, reliable advice, and a sense of security that will help your family live well and thrive!

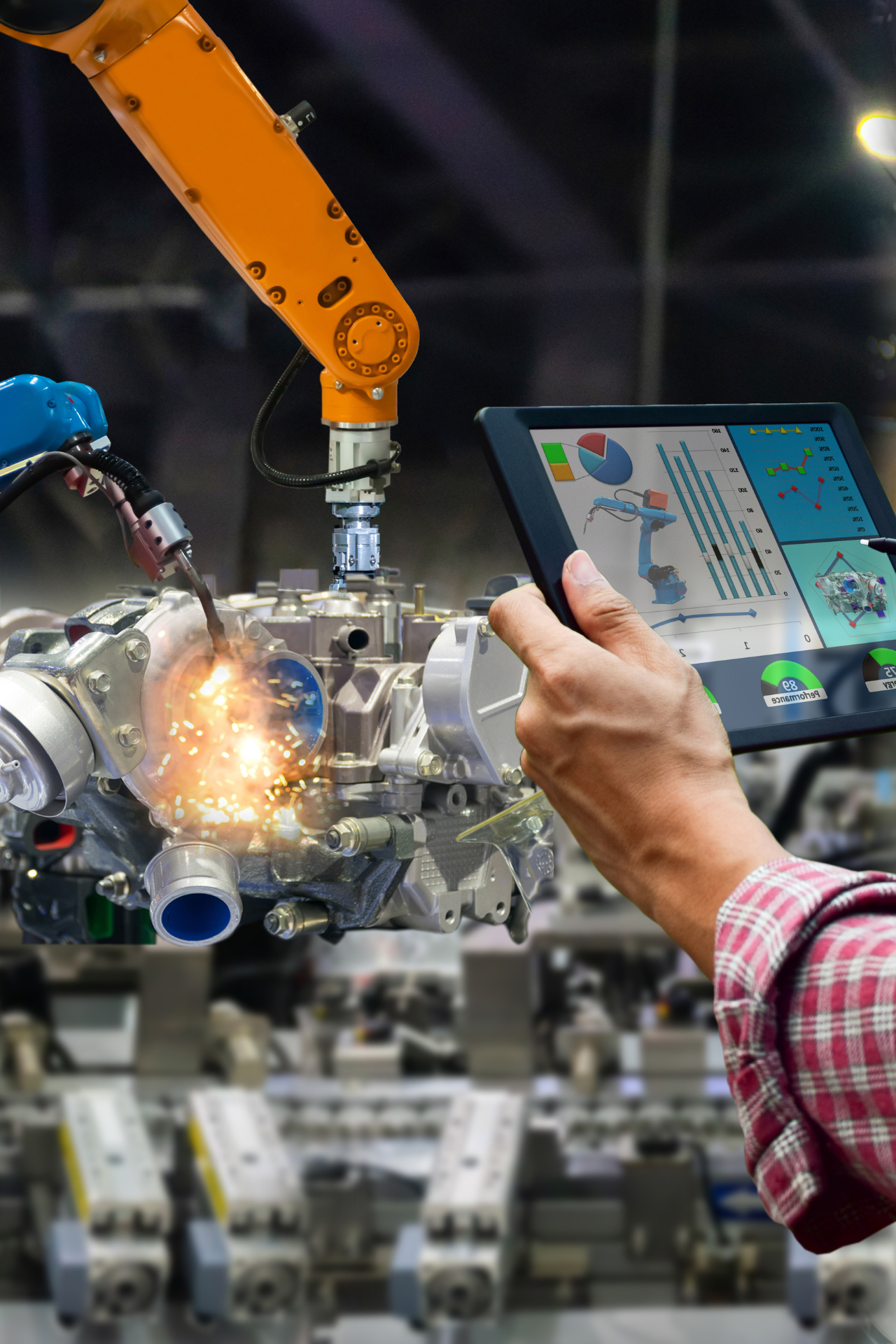

Business Insurance

Commercial Insurance Policies

General Liability Insurance

Comprehensive protection against lawsuits and other common business risks.

Workers Comp Insurance

Coverage for medical expenses and lost wages due to workplace injuries.

Commercial Property Insurance

Protect your business property from damage, theft, and natural disasters.

Commercial Auto Insurance

Insurance for vehicles used in your business operations, covering accidents and damages.

Professional Liability Insurance

Protection against claims of negligence, errors, and omissions in your professional services.

Industry-Specific Insurance

Businesses We Serve

FAQs

Frequently Asked Question About Braly Insurance Group

What's the difference between an independent insurance agent and a captive agent?

Independent insurance agents, like those at Braly Insurance Group, offer a wide range of insurance products from multiple companies, allowing them to compare policies and find the best fit for your needs. Captive agents are tied to a single insurance company and can only offer products from that provider. Choosing an independent agent in Texas provides access to a broader selection of options, ensuring a more personalized and cost-effective insurance solution.

Why should I choose an independent insurance agent in Texas?

Opting for an independent insurance agent in Texas means receiving personalized, unbiased advice across a wide spectrum of insurance options. Independent agents source policies from multiple companies, tailoring coverage to your specific needs, often at more competitive prices. They possess a thorough understanding of local insurance requirements and risks, ensuring your coverage is both comprehensive and relevant to Texas.

What are the typical insurance types offered by independent agents in Texas?

Independent agents in Texas typically provide a broad range of insurance types, including homeowners, auto, life, and umbrella policies, as well as specialized coverage like motorcycle and condo insurance. They offer customized solutions for various situations, ensuring you have access to policies that match your specific needs, whether you're protecting your family, home, vehicle, or personal assets.

What's the cost to collaborate with an independent insurance agent in Texas?

Engaging with an independent insurance agent in Texas usually doesn't involve any direct costs or fees for their advisory services. Agents earn commissions from the insurance companies for the policies they sell, allowing you to benefit from their expertise and personalized service without incurring additional expenses. Their objective is to secure the best coverage for you at the most competitive rates, aligning with your financial and insurance needs.

Why should I partner with a local independent insurance agent?

Partnering with a local independent insurance agent offers numerous advantages. They have a profound understanding of Texas' unique insurance needs and challenges, providing advice and solutions tailored to the local context. Local agents are readily available for face-to-face meetings, offering a level of personalized service that larger, non-local agencies can't match. Their commitment to the community means they're dedicated to finding the best insurance solutions for their neighbors, adding a personal touch to their professional services.

Personal Insurance options

Our Complete Range of Personal Insurance Solutions

Home Insurance

Protect your home with comprehensive coverage tailored to your needs. Secure your peace of mind today.

01

Car Insurance

Drive confidently with our customizable auto insurance plans designed for every driver and vehicle.

02

Boat Insurance

Enjoy your time on the water with our reliable boat insurance, covering damages and liabilities.

04

RECENT POSTS